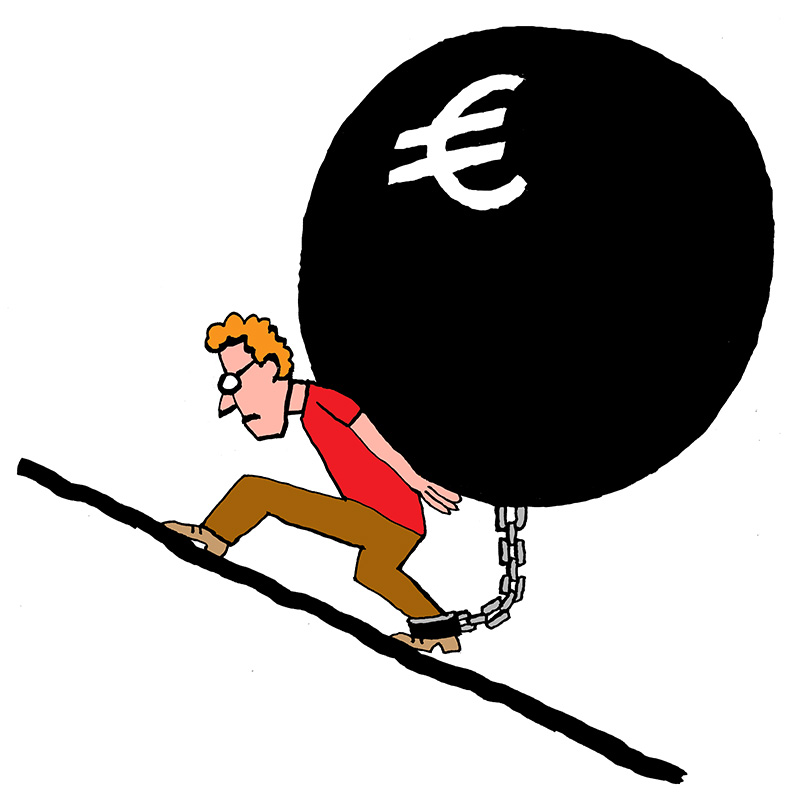

Saddled with a student loan: the duped loan generation

Now that political support has largely disappeared, the end of the student loan system seems in sight. It would mean that a generation of duped students is left with a large student loan debt. Moreover, a large group has never benefited from the promised educational investments. Is it a failed experiment?

It is reflected in almost all election programs: the abolition of the student loan system and the introduction of a new kind of basic grant. It seems to be an indication of the future direction in which politics will move. With the VVD as the only remaining supporter, it is likely that the student loan system will disappear after the elections.

Assuming that these are not just empty election promises, we will soon be able to speak of a true “loan system generation.” It is the generation of students who started studying at the time of the study advance and therefore built up a student loan debt that has been spared previous—and probably future—generations of students.

Within this loan system generation, there is a substantial group of students who have been unlucky twice over. These are the students who started studying at the beginning of the student loan system and missed out on later investments in the quality of education. For them: debt, but no improvement of education. It makes you wonder to what extent the student loan system can be called a successful experiment.

Fair deal

The current loan system is like this: students pay for their studies themselves by means of a student loan and receive better quality education in return. On paper it is a fair deal, says Marc Vermeulen, full professor of educational sociology at TIAS School for Business and Society (Tilburg University). “The loan is a profitable investment in yourself; a person earns an average of 6 to 8 percent extra in salary per year of additional studying. Moreover, the social conditions of the loan are reasonable.” With this, Vermeulen refers to the repayment term of 35 years, the low interest rates, and the idea of repayment according to ability to pay.

“This does not alter the fact that the practical implementation of the system turns out wrong,” Vermeulen adds as nuance. “Because the study debt is included in the mortgage calculation, the already precarious position of home-seeking youths is only made worse.” Vermeulen also points to the poor quality investments of educational institutions in the years before public money became available. “This was done by the skin of their teeth.”

It gives us the feeling that we have been used as a guinea pig generation

Youri Hoogewoning

For Vermeulen, however, this is not a reason yet to throw the entire system overboard again. “Such a change of course would be politically opportunistic, and, moreover, too quickly. All the more so because we still have little insight into the social effects. In addition, the question is how we are going to finance the planned educational investments at the moment when the income from the study advance is lost.” Therefore, Vermeulen proposes to review everything and make adjustments where necessary.

Higher student loan debt

In spite of the supporters of the system, it seems that the loan system will no longer be there in a few years time. “It gives us the feeling that we have been used as a guinea pig generation,” says Youri Hoogewoning, creator of the playful stunt (Dutch only) of sending a Tikkie, en masse, to Mark Rutte containing the amount of the accumulated student loan.

Hoogewoning is afraid that the possible abolition of the loan system will create a financial gap between them and the other generations. “I myself am in the fourth year of my program and currently have a student loan debt of around 19,500 euros. That is fairly average. Some, however, have a debt of around 50,000 euros.”

Bas van Weegberg, chair of FNV Young & United and one of the initiators of the #NietMijnSchuld campaign is wrestling with the fact that they build up a higher debt than previous and later generations. “It is unfair. Just because I was born in a certain year, I am now, after completing my studies, saddled with a debt of 33,000 euros”.

Hoogewoning and Van Weegberg are not the only (former) students with a debt, as became clear from a political review (Dutch only) of the loan system. Of all students who started studying at the university in 2015/2016 (the first cohort after the introduction of the loan system) about half will have a debt of more than 20,000 euros. Half of these will even exceed 40,000 euros.

The same study also found that the average student loan of a borrowing student after five years of studies is expected to exceed 24,000 euros. This is an increase of 9,000 euros compared to the old system in which the average debt of a student with a loan was about 15,000 euros.

The higher debt includes all kinds of problems. Van Weegberg: “In addition to the fact that the student loan is included in a mortgage application, students suffer from stress and psychological complaints due to performance pressure.”

“In addition, the debt increases inequality of opportunity because students from low-income families are more likely to forego development opportunities such as a board year, an experience abroad, or an honor’s program. In this way, they try to compensate for the financial burden of a student loan,” says van Weegberg. These are all things that were warned about beforehand and are now coming true.

Hardly any quality improvements

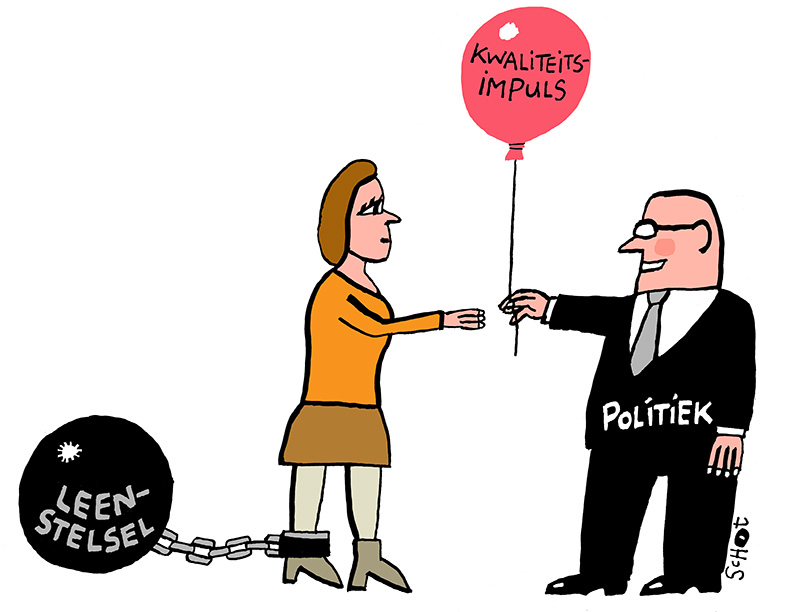

On top of the student loan, an early generation of borrowing students—students who started studying between 2015 and 2019—are even more disadvantaged. They have barely been able to reap the benefits of the promised quality improvements in education.

This mainly concerns students who started studying between 2015 and 2017. In this period, there was no money available from the government to invest in education. One of the reasons for this is that these funds only come in when students have finished studying and pay back the loan. Three years later at the earliest—when some of them had already obtained a diploma.

A report of the Court of Audit showed that only one third of the amount had actually gone to extra educational quality

To bridge this gap, it was agreed with higher education institutions that they would make a so-called “pre-investment” of 860 million euros. In this way, this beginning generation of students would also be able to enjoy improved educational quality.

However, a critical report (Dutch only) by the Netherlands Court of Audit showed that only one third of the amount had actually gone to extra educational quality. The rest of the investments had already been planned and were, therefore, not part of the loan system’s promise.

In 2018, money became available for the first time from the study advance, which meant that the government could finally start investing in extra educational quality. For example, in that year some 184 million euros were paid out to educational institutions and in 2019 some 192 million euros.

The NOS (Dutch only) calculated that if you add up these government investments and then divide this amount by the number of students who studied without a basic grant between September 2015 and August 2019, you arrive at an average amount of 33 euros per student per month. This is a bit of a write-off compared to the enormous student loan debts involved.

Finally, one may wonder to what extent these paltry investments have now effectively led to an increase in quality. It is only since 2019 that quality agreements (Dutch only) have been in place to ensure that the investments made actually result in an improvement in the quality of education. Educational institutions had to make their investment plans known, after which it was assessed whether the investments fall within one of the six themes that were set.

Both the pre-investments and the 2018 investments had not yet met these quality requirements and it is questionable whether they were spent in a way that directly benefits the student. As far as the 2019 investments are concerned, it cannot yet be said that they guarantee a higher quality of education: in September 2019, only 6 out of 18 universities and 1 out of 36 universities of applied sciences had their plans approved (Dutch only).

Too late in the day

In order to accommodate those students who were unable to take full advantage of the new system and the associated quality improvements, the government has created a voucher. A 2000-euro credit, which can be used for a new education. A generous gesture—at first glance.

An important caveat is that this voucher can only be used if the student has obtained a university of applied sciences diploma (Bachelor’s) or a complete university diploma (Bachelor’s + Master’s). In addition, the voucher can only be used from the 5th to the 10th academic year after obtaining this diploma. According to Van Weegberg, it makes the voucher a “mere eyewash.”

Waiving part of the student loan can certainly not do any harm, partly because it improves the current position of starters in the housing market

Marc Vermeulen

Five to ten years after graduation, former students are normally engaged in things like building a career or buying a house. Certainly, the loan system generation will not be eager to dive back into studying at this stage of life. They are mainly busy paying off their student loan. A free Master’s year would have been a better destination for the voucher because students would still be in their study phase. Now it feels like it comes too late in the day.

It should also be borne in mind that it is not financially attractive to use the voucher for an extra study program. For example, you have to pay institutional tuition fees of around 10,000 euros per year for a second Master’s, while former students are entitled to study financing up to a maximum of ten years after the Bachelor’s starting date. With a bit of bad luck, you will have to pay the remaining 8,000 euros for this study program out of your own pocket.

Compensation for the loan system generation

With the defective voucher, the early loan system students had to deal with a third blow. It is clear that they fell victim to the loan system experiment. Together with the late loan system students, who were less affected, they therefore deserve compensation. The question now is: what kind of compensation is appropriate?

One of the possibilities is (partially) waiving the existing debt for loan system students. Vermeulen: “Waiving part of the student loan can certainly not do any harm, partly because it improves the current position of starters on the housing market.” Hoogewoning, however, sees an objection to such a waiver. “By opting for a waiver, you are penalizing students who have worked hard to finance their studies. As a result, they have built up little or no debt for their studies and will not benefit from a possible waiver.”

Van Weegberg sees more in a generic compensation of 10,000 euros for all students who studied during the loan system. “Given the lack of necessary data—who spent the loan and on what, who stayed at home and who didn’t—it is mostly practical to work with a fixed amount. Moreover, it is a sum of money that is somewhat close to the average increase in student loans due to the loan system.”

“I don’t think this kind of shotgun approach is the solution; it’s too simplistic and a lot of money is wasted this way,” says Vermeulen. “Financial compensation does not have my preference at all, because I fear that this money will then be spent on the wrong things. That’s why I’m in favor of a mortgage guarantee for the loan system students. This way you save the money in a place where the real problems arise, the housing market in this case.”