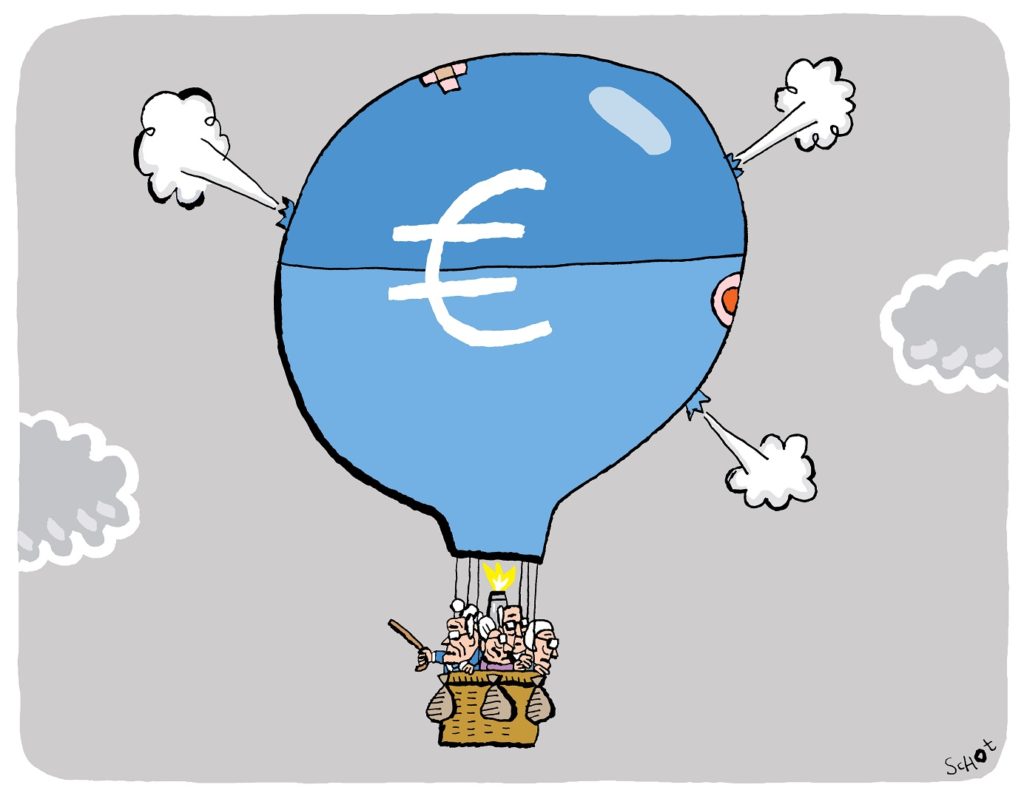

A new Dutch pension system: what will it look like and will there still be something left for younger generations?

Save the date: as of January 1, 2023, we will say goodbye to our old pension system and welcome a thoroughly reformed pension system in the Netherlands. For those who are now thinking: “if I ever get to retire, that pot of money will probably be empty,” there is hope. At least, according to TiU economist and pension expert Ed Westerhout. Univers asked him what this important reform means for our future senior citizen’ wallet.

Will there still be a pension for me? Many young people wonder. Which is not surprising. The pension system has been the subject of much negative publicity lately. There has been talk of “evaporating pension pots of money” and “falling coverage ratios.” Will young people be left empty-handed in their old age?

According to economist Ed Westerhout, who works at the Tilburg Tax Institute, a few important things are going to change that could affect the ultimate amount of our retirement provision. But he also sees positive developments.

Recent research by the NIDI (Dutch only) shows that younger generations are hardly following the discussions regarding the new pension system. Moreover, they are poorly informed about their own pension accrual. Is that a problem?

“It’s not unimportant, of course, but I’m no exception myself. I wasn’t very concerned about it either in my younger years. You don’t look that far ahead; you live in the moment. I think this attitude shows precisely why our mandatory collective pensions in the Netherlands are so valuable. Even for those who aren’t concerned with it, it’s all still being arranged.

“At least when you’re working for an employer, for self-employed people and also for certain types of flexible work it’s different.”

How can you build up a pension in the Netherlands?

- From the government: the AOW (General Old Age Pensions Act). This is paid to everyone who lives or works in the Netherlands.

- From your employer: pension. If you have a job, you often build up a pension through a pension fund, insurer, or PPI (premium pension institution).

- A pension that you arrange yourself. For example, with an annuity or a (bank) savings product.

(Source: mijnpensioenoverzicht.nl/?language=en)

Why was it necessary to reform our pension system?

“This is particularly necessary because of the ageing Dutch population. In the past, there were four people at work for every pensioner; soon there will only be two.

“Due to the ageing population, premium income is steadily declining while expenditure on pensions continues to rise. If something goes wrong, the investments are performing badly, or interest rates are unexpectedly low, pension funds will be short of money.

“In the past, they could raise the premium (the amount employers and employees pay for pension accrual) by a few points and then more money would come in. But because the number of premium payers is lagging, that’s not very effective anymore.”

What are the most striking changes in the new pension system?

“The biggest change is that we are moving from pension entitlement to pension expectation. At present, pension funds say: if you have worked for so many years and built up so much, you can look forward to a pension of X percent of your annual salary. They cannot guarantee this, but the amount you will receive after retirement is fairly certain. Pension funds are obliged to maintain buffers with which they can supplement the pension in times of reduced income.

“Under the new system, while they are still aiming for a similar percentage of your annual salary, it could be more or less. The chance that it deviates from earlier expectations is much greater. The guarantee disappears. And because there are no guarantees, pension funds no longer have to maintain large buffers on behalf of their regulator, the Dutch Central Bank. That will free up some money for the participants.

What happens to the money that is released?

“Pension funds can take that into account to cushion some blows in the future. They can also say that we will grant indexation to current participants more quickly. They have had very little indexation for price inflation for ten years, their pensions have fallen behind. These system changes will offer opportunities to compensate for some of that.”

So, the people who are now retired or about to retire will get more money?

“Those pensions could indeed end up a little higher than they would be if there had been no reform.”

That sounds like an extra gift to a generation who are already home and dry.

“That has never been the approach, I don’t believe. The changes are desirable because the system is unaffordable at the historically low interest rates of recent years. A CPB study into the generational effects of the new system did show that, on average, pensioners have a plus because their buffers have been released and funds are able to index sooner.

“Future generations are worse off because there are fewer buffers to absorb setbacks. They have to deal with those financial blows more.”

The second major change is that we are changing from an average system to a system of degressive accrual. What does that entail?

“At the moment, every employee pays an average premium: regardless of your age, you pay the same pension premium and have the same pension accrual. However, the premium of a young person is worth much more than the premium of an older person. Each euro paid in by a young person can still generate a return for a very long time, whereas the euro paid in by an older person is worth much less.

“So, the very young do not pay part of their contribution for themselves but for the older workers. When most people stayed with the same employer and the same pension fund for life, that wasn’t a problem. Then you automatically became the older employee who also benefits.”

Why is it a problem now?

“Nowadays, it is more common for people to start for themselves or change jobs. This revealed a significant inequality. For example, if you leave the system at the age of around 45, you have invested much more than you will ever get back. The amount that you have built up will remain, but the value will no longer increase.

“This average premium will disappear in the new system. The pension premium will remain the same for all age groups, but the pension accrual will differ. It will decrease as the employee grows older. We call this degressive pension accrual. In principle, the younger the participant, the higher the pension accrual. That is how you save for later.

What about the middle generations? They have been paying into the old system for some time but are not yet retiring (by a long shot).

“Those people have indeed paid much more in premiums than they have accrued in rights. If there is no compensation, they will lose that money. Together with two colleagues, I recently published the Netspar and CPB report Completing Dutch pension reform, in which we identify this as something that still needs to be finalized. There are plans for a compensation scheme, but it is still unclear whether it will be introduced and what form it will take.”

People accruing a pension will also have more freedom of choice in the new system, but how?

“Those retiring will soon be allowed to withdraw up to a maximum of 10 percent of their accrued pension assets in one go. This is also known as the lump-sum payment. That is unique in the Netherlands and makes our pension system a little more flexible. Perhaps you want to pay off your mortgage, improve your home, or go on a big trip?

“There can be all kinds of reasons for wanting to receive a larger amount at once. In other countries, this is already very common, and you can sometimes withdraw up to 100 percent.”

There is a large group of people in the Netherlands who are self-employed and have to build up their own pension. What will change for them in 2023?

“The new pension agreement includes compulsory occupational disability insurance for the self-employed. In this way, these people are also assured of an income during their working lives in the event of illness or an accident.

“You could go much further, by also making pension accrual compulsory for the self-employed. Research by the Social and Economic Council (SER) shows that a large group of people who are self-employed do not build up a pension.”

The new pension system is more dependent on investment returns. What risks does that entail?

“Because the pension funds will no longer have large buffers, there is a greater chance that your pension will be higher or lower than you thought. That depends on how the investments are doing. On the other hand, they are introducing a form of age-dependent investment. In other words, the pension fund is thinking about who to invest for, so you can limit the sharp edges of the risks.

“Do I invest for a young person? They still have a long future ahead of them and can absorb the blows on the stock market in all sorts of ways. So, you can invest more in shares and less in bonds. With shares, you have a greater chance of making a higher profit, but the risk of loss is also greater.

“Are you investing for an elderly person? They are already closer to retirement. Then you don’t want to take too many risks anymore and you increase the role of bonds. Bonds, for example Swiss or German government bonds, are very safe. At the same time, they also yield less.”

But what are the real risks? Could your pension turn out to be much lower than expected?

“Pension funds are now obliged to report the higher risks that people run. On mijnpensioenoverzicht.nl you can therefore find three scenarios, the expected pension, and the amounts in case the returns are better or worse.

“Theoretically, it’s always possible that you end up lower than the lowest scenario or higher than the highest.

“Because the pension guarantees will soon be abandoned, there is a greater chance that a reduction will take place. Is there a problem with pension revenues? Then pension funds will say: we’re just going to give a little less. Every year, the fund re-evaluates its policy. So, it can go down two years in a row, but it can also go up several years. Just like with stock markets.

A pressing question for many young people is: will there be any pension left for us at all?

“The state pension is in the hands of politicians, and they can go back on previous agreements. In theory, you could abolish the state pension if there were a political majority in favor.

“You build up a supplementary pension yourself. Your rights and obligations are set down by a pension fund, which cannot simply be canceled. The political risk is smaller with supplementary pensions, but the financial risk is much greater. The state pension is paid for by those currently in work, so there is little financial risk involved.

“But, to come back to your question of whether there will still be pensions for the new generations: the likelihood that there would be no state pension or supplementary pension in a few decades’ time, I consider to be out of the question.”

Some young people would prefer to enjoy the Swiss Life at a young age and are throwing themselves into the FIRE (Financial Independence and Retire Early) movement (Dutch only), how do you view that?

“A little bit with fear and trembling. The idea seems simple: by earning well and spending little for a few years, you can build up enough capital to live on for the rest of your life. However, if you make an honest calculation, the problem emerges: how much capital do you need to be able to retire freely for the rest of your life? You don’t get any interest on your savings anymore, so just saving is hardly ever enough.”

Because your money doesn’t increase?

“Exactly. Only when the interest rate is around 5 percent again can you achieve attractive effects. With zero to half a percent you achieve nothing. Many people then think: I’m not going to save, I’m going to invest.

“And then I can realize that 5 or 6 percent return. But that is only an average. It can also be zero or even negative, even over a number of years. Then you run a very big chance that you overestimate your wealth.”

So just joining a pension fund might be safer?

“The chance that you’ll have to bite the bullet and run into financial difficulties is much greater if you invest everything independently. Pension funds are not individual investors, it is all done collectively. Their experts spread the investments over several industries and several countries. And then you also have the supervision of the Dutch Bank, which is an extra guarantee. The chance of something going terribly wrong there is a lot smaller.”