A little nudge in the right direction

A new wave of economic thinking has come about, sweeping away our faith in the old gods of fines, taxes and subsidies. The new economist believes in the power of nudging. According to Tilburg University’s pioneers of behavioral economics, nudges can help imperfect human beings make better choices. And that goes for imperfect students too.

American economist Richard Thaler recently received a Nobel prize for making economics a little more human. He confronted the world with a shocking reality: when it comes to money and finances, people make terrible choices. Sadly, we are not the rational, self-controlled decision makers that old-school economists believe us to be. When the New York Times asked him how he was going to spend the million dollar prize that comes with winning a Nobel prize, Thaler jokingly said that he would spend it “as irrationally as possible”.

In Tilburg, meanwhile, a group of economists and psychologists were overjoyed to see Thaler win the Nobel prize for economics. Among them was professor Jan Potters, who has spent the last two decades bringing the fields of economics and psychology together at Tilburg University. “As a behavioral economist, I’m very excited that the Nobel prize has been awarded to Richard Thaler. It’s an encouragement for all of us, and a recognition of the importance of what we’re doing.”

Old-school

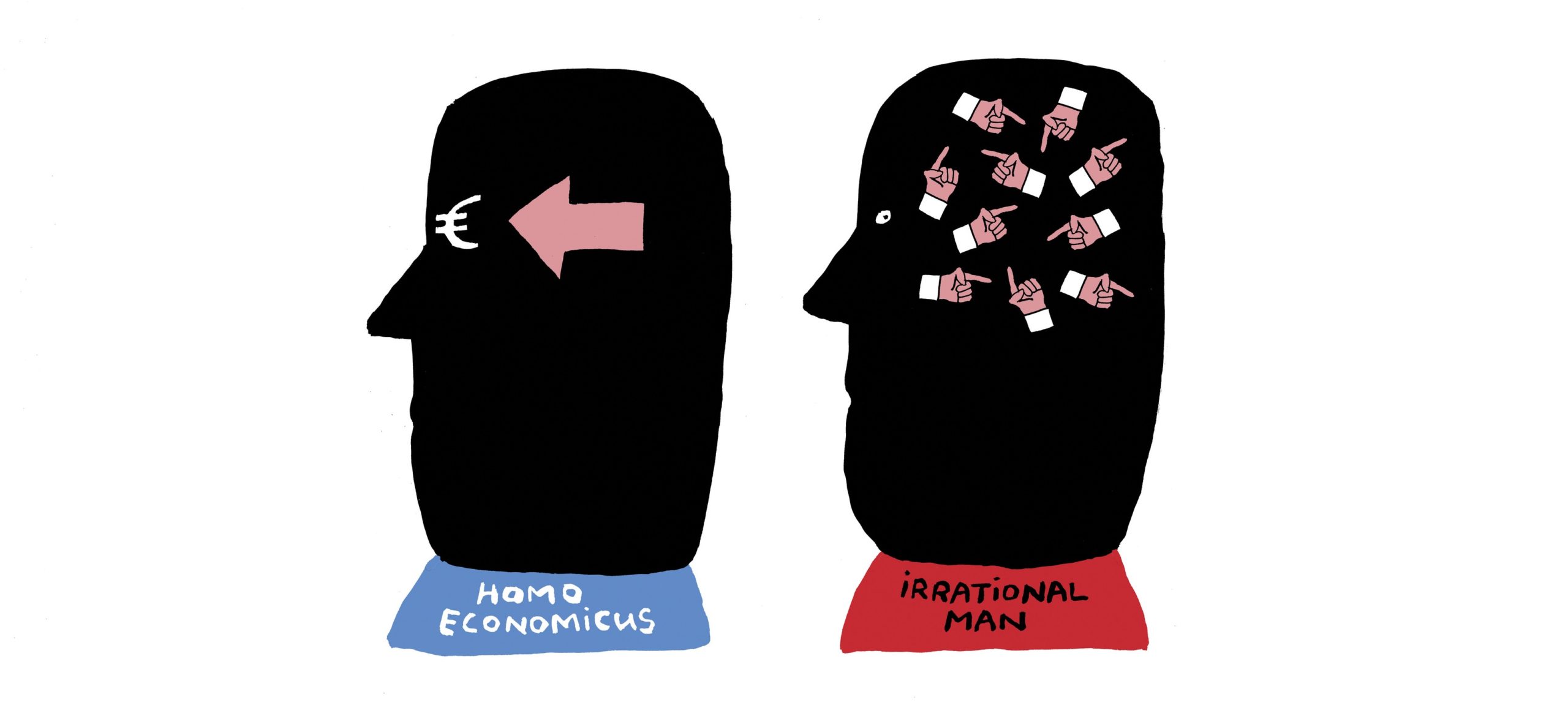

When Potters was an econometrics student at Tilburg University in the 1980s, behavioral economics wasn’t part of the curriculum. “In my time, students were taught standard economics. And that was it.” But the problem with standard economic theories, Potters says, is that they completely ignore the human factor “Conventional economists assume that people are endlessly rational and endlessly selfish, and that they always make the best possible decision which serves their long-term interests. In reality, those assumptions don’t hold up.”

When Potters became a professor of economics at Tilburg University, he wanted to do things differently. He joined forces with professor of social psychology Marcel Zeelenberg. “We started working together about sixteen or seventeen years ago, when we decided to organize a joint symposium for economists and psychologists.”

The symposium has been held every year since then. “It was an immediate success, and it still is”, Marcel Zeelenberg says. “We’ve welcomed some of the biggest names in our field as keynote speakers over the years. Eventually, we founded TIBER: the Tilburg Institute for Behavioral Economics Research.”

Pioneers

The relationship between the departments of economics and psychology has proven to be more than just a flirt. It’s a marriage that spans decades, dating back years before Potters and Zeelenberg started working together. “Tilburg has always played a pioneering role in merging psychology and economics”, Zeelenberg says. “Economic psychology, which is very similar to behavioral economics, became a field of expertise at Tilburg University as early as the 1970s.”

And the pioneers of behavioral economics on campus aren’t just visionary professors, researchers, and teachers. Whether they know it or not, many Tilburg University students and alumni have contributed to the field of behavioral economics as well. “For the past twenty years or so, we’ve been conducting experimental research in our lab”, Potters says. “In most of the experiments, the subjects are students. They’re a big part of the studies that we conduct here.”

Nudges

Richard Thaler is best known for popularizing the concept of ‘nudging’. Nudges are an alternative to standard instruments used to influence choices, such as fines, subsidies, and taxes. Zeelenberg: “A nudge is a ‘soft’ way to change people’s behavior. It’s a push in the right direction, to help people make decisions that affect their finances, their health, their happiness.”

Richard Thaler is best known for popularizing the concept of ‘nudging’. Nudges are an alternative to standard instruments used to influence choices, such as fines, subsidies, and taxes. Zeelenberg: “A nudge is a ‘soft’ way to change people’s behavior. It’s a push in the right direction, to help people make decisions that affect their finances, their health, their happiness.”

Nudges are whispers rather than shouts, and they often go unnoticed. “Subtle changes that may seem insignificant can actually have an enormous impact on human decision-making”, Potters says. “Nudging works for all kinds of consumers – from tax payers to potential organ donors – and for influencing all kinds of behavior.”

Nudging students

What about struggling students? Can nudges help them do the right thing too? According to Marcel Zeelenberg, the answer is yes. There are some simple ways in which university teachers can give their students a nudge in the right direction.

“For teachers, the way you present choices to your students matters”, Zeelenberg explains. “Imagine that you teach a course that consists of both lectures and tutorials, and you want as many students as possible to attend the tutorial sessions. At the start of the course, you could tell your students that they need to register for the tutorial sessions if they choose to participate. But you could also tell them that they are automatically registered and they need to unregister from the tutorial sessions if they won’t be participating. If you do the latter, more students will attend the tutorial sessions.”

Zeelenberg gives another example. “Students often struggle with deadlines. If a course requires students to write a paper and to take a final exam, you could set the deadline for the paper at the end of the course – that way, the paper would be due around the time of the exam. But for students to succeed, it’s better to set the deadline a few weeks before the exam.” That seems strange, because students can always hand in a paper two weeks before the deadline if they wisely choose to do so. Wouldn’t it make more sense to give them as much time as possible, then? Oddly, that’s not the case. “Setting deadlines can help students plan their work more efficiently.”

Irrational but predictable

Students, like the rest of us human beings, don’t always benefit from having complete freedom of choice. Making the right choices, whether about studying, budgeting or planning for the long future ahead of us, is not an easy task.

Behavioral economists, it seems, are tellers of bad news and good news. The bad news is that we are all irrational. The good news is that we are predictably irrational. As long as economists and psychologists continue to make sense of our strange impulses and disastrous decisions, we’ll be just fine.Thijs Brouwer, PhD student in behavioral economics

“My favorite example of a nudge that achieves long-run effects entails the mailing of Home Energy Reports to households. These reports provide households with information on their energy use and advice on how to easily save energy. More importantly, the reports compare a household’s energy usage to that of comparable households in the neighborhood. The reports show to what extent households consume more or less energy than their neighbors. For example, a household’s relative performance is indicated by different smiley faces. The social-comparison feature of this nudge is powerful, since human beings have a tendency to strive to be better, in whatever way, than their friends, family, or in this case, neighbors.

Alcott analyzed the effect of Home Energy Reports in a field experiment where households were randomly selected to receive a report. He shows that the reports on average achieve a decrease of 2 percent in households’ energy usage. This may not sound like a lot, but considering that the reports are now being sent out to 15 million homes, these small changes quickly add up to be substantial in the aggregate.

Obviously, the question remains whether the Home Energy Reports really changed habits or whether the effects result from investments in more energy-friendly technology and appliances. This is where us scientists should come in to disentangle the two mechanisms…” Niels van de Ven, associate professor in economics and marketing

“One of Thaler’s best ideas and most influential nudges is his idea to “Save More Tomorrow”. People often know they should save more money, but find it difficult to do so. After all, if I have to save more money this implies that I should give up something that I am spending money on right now. Thaler’s solution? Ask people to indicate how much they are willing to save from their next salary increase.

Imagine that you expect to receive a salary increase of 100 euro next month. It’s easy to indicate you want to save 50 euro a month from that salary increase; you can save money and still have 50 euro more per month than you do now! Almost 80% of people in the Save More Tomorrow program started saving more with this simple change. This has a tremendous impact, as in the U.S. people are not obliged to save for their pension and many people save too little. Thaler’s method has helped (and still helps) many people to be better prepared for their future.

Some question the ethicality of nudges: are we not pushing people to do certain things? However, Thaler’s work has also helped us realize that the way a choice is presented is never a neutral action: it’s a choice to place the unhealthy snacks next to the check out. It’s a choice whether a society’s system of organ donations is opt-in (you have to actively register if you want to be a donor) or opt-out (you have to actively indicate if you do not want to be a donor). Both options allow free choice on whether people want to be a donor or not. Why not choose the system that potentially saves 100 lives a year? I would argue that, if anything, it’s actually unethical to not think about how we can present options in a way that will maximize people’s overall well-being.”